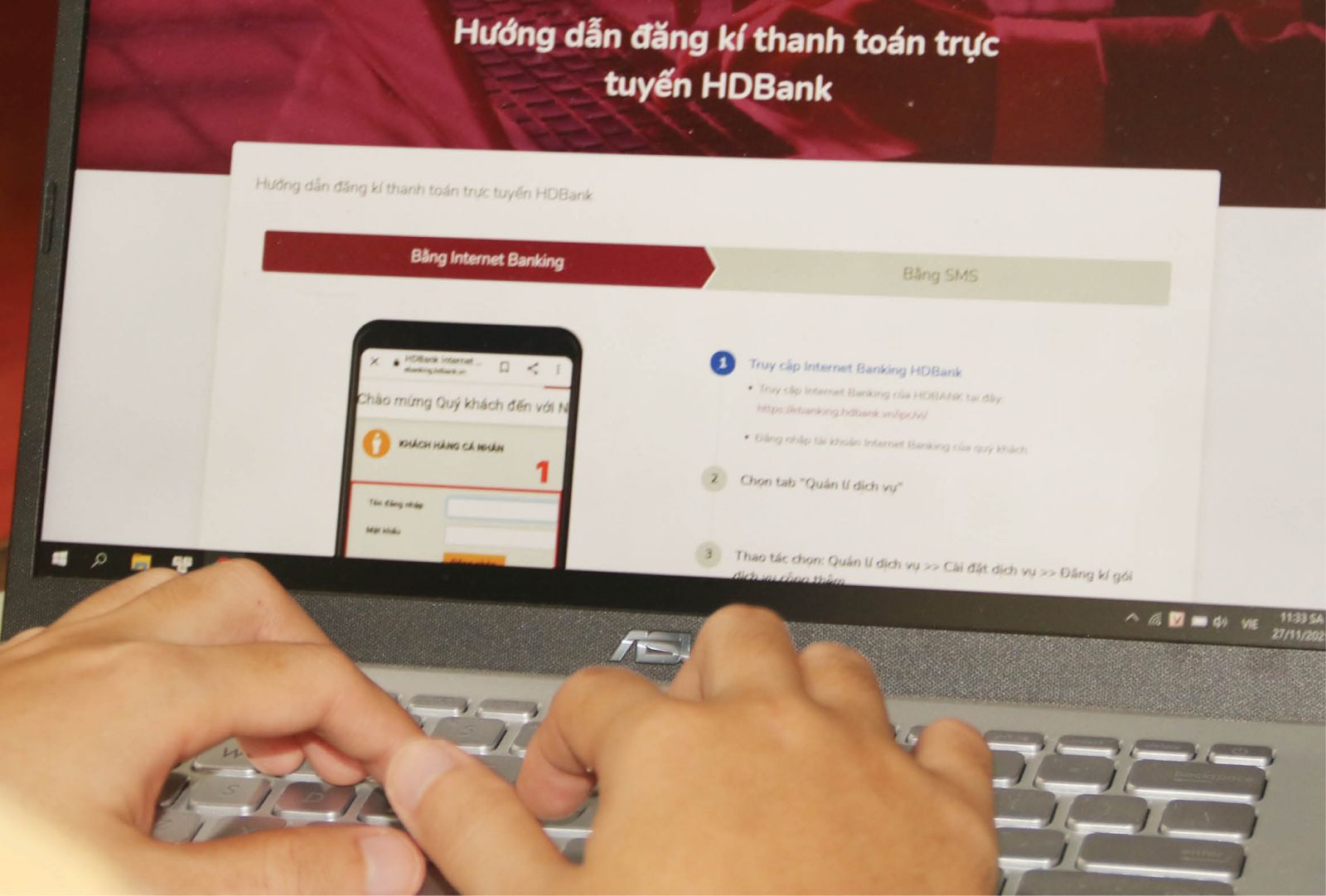

Online payment via HDbank

The first sector to have Digital Transformation Day

At the DT event held in Hanoi in early August, after choosing May 11 as Digital Transformation Day for the banking sector, Prime Minister Pham Minh Chinh, Chairman of the National Committee on Digital Transformation, emphasized that the banking sector has all the factors to be a pioneer in the DT process; transforming from using information technology (IT) to DT is a revolutionary transformation.

Deputy Director of the State Bank of Vietnam (SBV) of Thua Thien Hue, Chau Khac Thai said that 100% of banks in the province have been developing the DT strategy. Most banks have approved strategies or integrated them into the development orientation of business and IT. Not waiting for the SBV to promulgate the DT plan in 2022, in fact, over the years, banks were quite quick in the implementation of DT applications and services to serve customers.

The past two years of the pandemic proved that DT is extremely effective, especially for the banking sector, which is the lifeblood of the economy. Most banks offer a variety of services to customers on digital channels: bill payment, e-commerce payment, money transfer, online savings, professional operation digitalization, electronic signature application, internal digital signatures...

Simultaneously, they combine with mobile device technologies, open data connection according to the application program interface, data analysis, electronic information standardization according to the international financial electronic information standard ISO 2022, and customer support technology.

Vietcombank is one of the first banks to cooperate with the Research and Application Center for Residents Data (RAR Center), the Ministry of Public Security, in successfully developing the chipped-based identity (ID) card application in bank transactions at ATMs as well as over-the-counter transactions. It takes only 5-8 seconds for the system to verify customer information with a chip-based ID card; in less than 2 minutes, customers can complete a withdrawal transaction.

The cash-out feature with a chip-based ID card is automatically integrated when customers choose to use the service; customers do not need to register to use this service with banks. Vietcombank also developed the chip-based ID application in customer identification when making transactions at the counter.

HDBank develops DT in the spirit of "Change is vital, digitization is obligatory". HDBank selects the DT orientation in line with its long-term business strategy with the following key distinct characteristics: focusing on customer journeys, optimizing operational processes, establishing the DT center...

Director of HDBank Hue, Nguyen Viet Anh affirmed that DT is an inevitable trend to help the banking sector to offer more benefits to the economy. Thanks to DT, the smooth circulation of currency in all contexts is ensured for banks and customers. The rising rate of smartphone users, increasing resident connection to the Internet, and the IT presence get the DT process working well.

Competition via digital banking

A survey conducted by the SBV shows that DT helps banks save more than 50% of costs. Once they have access to customers, banks tend to approach digital banking services more and more deeply and boost a multi-dimensional integration in providing financial services packages...

In 2022, NamAbank will continue to increase investment in and apply IT, making new strides in DT; continue to perfect the digital banking ecosystem: Robot OPBA, Open Banking, and ONEBANK, meeting the needs of transactions anytime, anywhere, 365+, including holidays...

Many commercial joint-stock banks have advocated for huge investment in DT. NCB is determined to continue investing heavily in technology to make headway in DT. This bank creates different products and services, meeting the transaction needs of customers anytime, anywhere. Concurrently, the comprehensive strategic cooperation with many economic organizations as well as large corporations initially provides diverse products and services for customers in the partner's ecosystem.

According to the SBV of Thua Thien Hue, 52% of banking operations allow the bank to perform entirely in the digital environment; 43% of customer transactions are done through digital channels; 26% of banks have a proportion of revenue from digital channels; 26% of decisions on disbursement and lending of commercial banks and financial companies for small loans and consumer loans of individual customers are made in the direction of digitization and automation; 50% of work records at the bank are processed and stored in the digital environment.

The transaction value on the Internet and mobile banking channels of banks in 2021-2022 rose more than 20 times against before the COVID-19 pandemic; the mobile banking channel alone rose more than 10 times. The great potential of the digital banking channel has paved the way for the race for the second trend: investment in technology and DT in the banking system.

SBV judged that in parallel with the race to build and position brands for typical digital banking application products such as VCB Digibank, VPbank NEO, VietinBank iPay, and My VIB..., there is another underground race in the banking sector: enhancing technology capacity in preparation for the threat from fintech companies and non-cash (mobile money) services in the short run. Techcombank chooses Amazon Web Services as its partner that provides cloud computing services. VietinBank, ACB, TPbank... develop solutions to exploit Big data, artificial intelligence (AI), and ML into customer data analysis.

By 2025, new business models will have managed about one-third of traditional banking revenue. The popular digitization trend is in the segments of retail, small and medium-sized enterprises.

In the 2022 DT project, one of the solutions proposed by the SBV is to foster cooperation between the SBV and enterprises to develop digital platforms for research, development, and use of high-quality, digital platforms. Standardized software services are used for e-government development in ministries and sectors to build e-Government at the SBV, making it possible for enterprises to introduce and provide digital products and services. for the banking sector…

Story and photo: Bach Quang